Liberals flip-flop on wealth tax for 1% gifts the NDP a huge opportunity

Mark Carney reveals the extent of his neoliberal delusions for mythical market-driven, top-down progress by opposing capital gains tax increases leaving a huge opening for Jagmeet Singh.

For almost a decade, the NDP have pressured the Liberals to implement a wealth tax to increase government revenue for social programmes. It’s popular with working Canadians, and progress seemed to finally be on the horizon last year. Now delays have turned into a total cancellation – just one more empty, unfulfilled promise from Trudeau’s Liberals.

Supposed economic wunderkind Mark Carney has long been labelled the ultimate Bay Street insider, and he didn’t do much to dispel that in his 5 February speech, copying his Liberal Party leadership rival Chrystia Freeland by regurgitating the stale, long-disproven mantra that enabling the 1% to dodge taxes will somehow magically increase investment in innovation, sustainability and jobs by “growth leaders.”

I want to be crystal clear about this: My government will use all its powers to protect Canadians and to build in the national interest.

The government of Canada has extraordinary powers at its disposal today to respond to a national crisis, and Donald Trump's aggression against Canadian livelihoods and workers constitutes just such a crisis. And since it's a time to build we can change how builders are rewarded in this country. That's why I will reverse the government's capital gains tax increase, not least in recognition of the vital role that builders play in shaping our country's future, and ensuring we drive investment, innovation and growth.

That’s right folks – good old Mulroney-esque trickle down economics, with just enough contemporary spin to appease the techbros! Retro-80s will never die! What the Weeknd is to pop music, Carney is to politics!

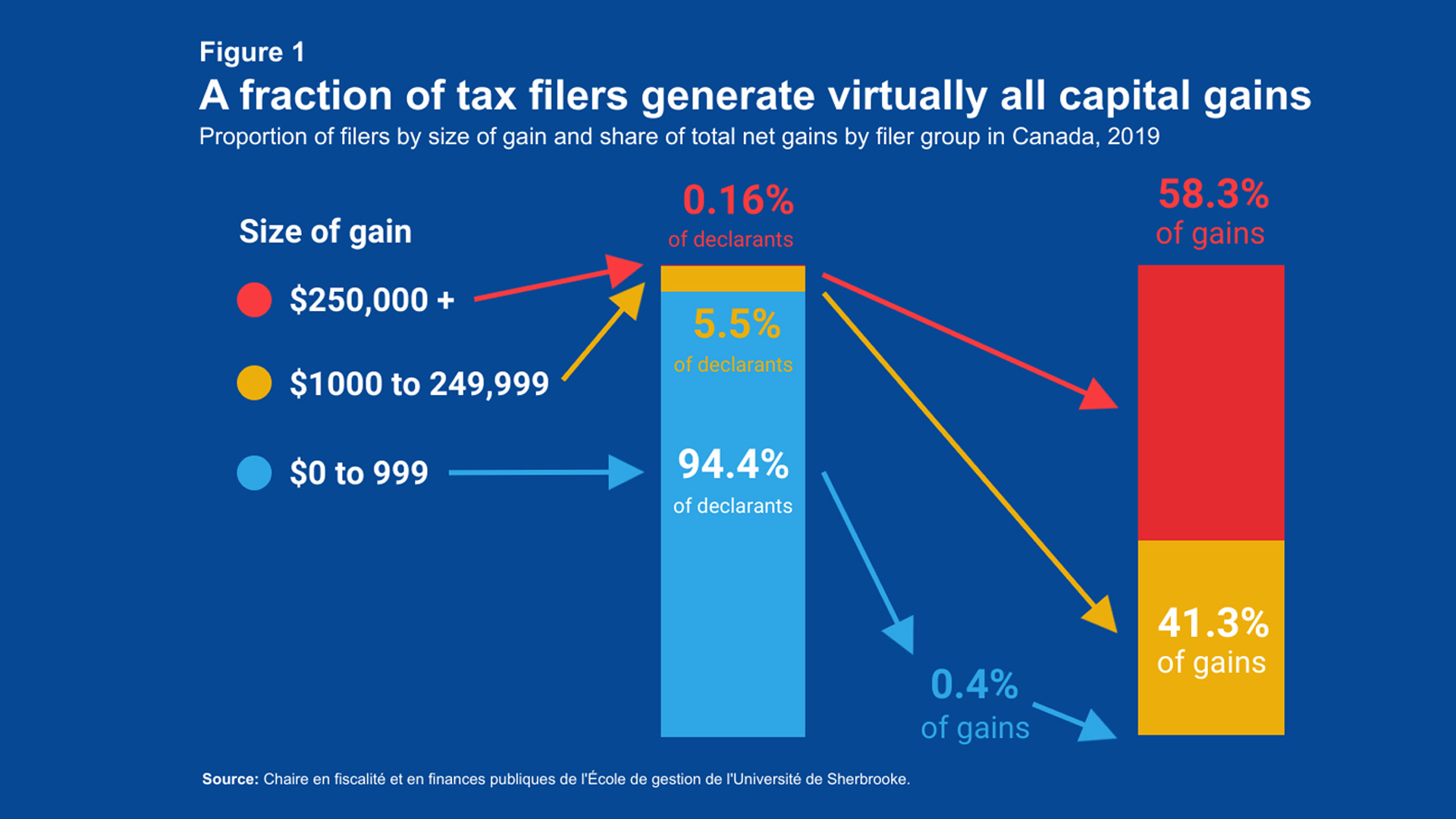

There’s so many angles to refute this idiocy. First of all, reversing capital gains tax increases does not “protect Canadians” – less than 6% of Canadians file a capital gain over $1000 – it protects the super-wealthy elites from paying the same effective tax rate as ordinary working Canadians. That’s not the same thing, though maybe those are the only Canadians Carney knows?

Secondly, Carney’s notion that the super wealthy, who he euphemistically calls “builders,” are not already sufficiently “recognized” through financial rewards.

Canada’s 100 top CEOs were paid 210 times more than the average worker’s wage in 2023 on average. In 2020, the Parliamentary Budget Office reported that the top one per cent of families hold about 25.6 per cent of the wealth – about $3 trillion. They may not all be TikTok yacht influencers (though most probably are), but that seems recognition a plenty.

[…] capital gains inclusion have historically had no impact on the pace of investment and innovation by Canadian business.

Jim Standford, economist

Tempting as it is to mock Carney’s logical backflips connecting personal tax breaks for millionaires and billionaires to “innovation and growth leadership” (because clearly the tax-hating neofascist broligarchs south of the border must be right), let us turn our attention to the esteemed NDP MP and deputy critic for innovation, science and industry Richard Cannings, who will be retiring this year. Cannings serendipitously made a well-argued rebuttal to Carney’s nonsense recently in The Hill Times. He writes:

Our current corporate tax structure discourages investment in research and development (R&D), and the adoption of advanced technology by the private sector.

Currently, Canada rates 19th place amongst OECD nations for R&D spending as a share of gross domestic product. Our business-sector R&D spending as a share of GDP is the second lowest in the G7.

In terms of adoption of advanced technology, private sector spending from 2020 to 2022 was only $6-billion. For example, a 2022 study by StatsCan found, “only 3.1 per cent of businesses reported using artificial intelligence, while 2.1 per cent reported using robotics.” Two of the main reasons given for not investing in advanced technology were cost and, “that investments in advanced technology were not necessary for continuing operations.”

It is clear the private sector is not supporting innovation in this country, whether through direct investment in R&D or in the adoption of advanced technology. It is also clear that as long as government policies allow businesses to survive without investing in innovation, our economic decline will continue.

Cannings continues to school Carney on how innovation could realistically be achieved:

To reverse this trend, Canada should be structuring its corporate taxes to encourage investment in innovation. Further, we should be encouraging competition rather than protecting the markets for a handful of corporations. To accomplish this would require an overhaul of current governmental thinking. Failure will result in the continued decline in our economy, reduced standards of living and reduced or eliminated public services.

Cannings also released a statement on 10 June 2024, referring to the capital gains tax adjustments the Liberals have now binned:

The NDP supports these tax changes as that they take some steps towards tax fairness while protecting the savings of small business owners. If this were an NDP government, we would add other measures to speed up tax fairness, including an excess profit tax to access some of the billions of dollars that big oil companies have been taking from Canadians at the pump. Its time for tax fairness between workers who pay their fair share and the rich 1% that are accumulating massive wealth while most Canadians continue to struggle.

Cannings goes on to explain exactly how specifically micro-targeted the Liberal-NDP capital gains tax increase was at the super wealthy – who negotiate compensation packages to favour stock options over salary in order to dodge taxes – and pay a lower effective rate than the average Canadian. The statement is well worth reading in its entirety. Given this context that the corporatist legacy media won’t provide, and complete lack of any co-relation of personal wealth taxes to innovation, Carney’s decision and the nonsense economic reasoning behind it is hard to stomach for any Canadian struggling to pay the bills.

At some point Carney’s honeymoon period concludes and the free ride ends. While Carney kneels before every misguided Bay Street demand (and he should be smart enough to know better!), hoping to delay legacy news media scrutiny for a while longer, Jagmeet Singh and the NDP have a chance to stand tall and explain how innovation, investment and jobs can actually be achieved in this country by putting workers, green infrastructure and smart investments first.